Submitted by M. R. Hamilton on

Submitted by M. R. Hamilton on

So now that you have gotten your limited liabilty company and have sent your SS4 Application for Employer Identification Number off to the IRS what happens next?

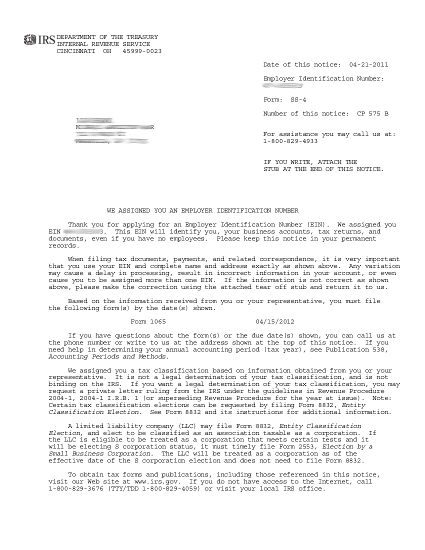

After what is far too long, but typical of federal government bureaucracies, you will get a letter from the IRS assigning you your EIN and informing you that you are required to file a form 1065 by April 15th of each year. The following is from an actual letter received by this author with the personal information smudged out for all of you shady characters out there.

Click on the images to view a larger copy of it. Note the third paragraph which states,

Click on the images to view a larger copy of it. Note the third paragraph which states,

Based on the information we received from you or your representative, you must file the following forms by the dates shown.

Form 1065 04/15/2012

Do you remember what you put on your SS4? On that application you specifically said you need it "for banking purposes". You also stated in blocks 8a. and 9a that you had a limited liability company. So where did the IRS get the notion that you are required to file a form 1065 "US Return of Partnershiip Income? It takes this position by default on everyone, because they have been successful in lying for so many years, they just figure you will go with it.

So the next thing for you to do is write them a letter to put an end to the misperception on the part of the IRS. You do not have to be afraid of them. The IRS is merely a collection agency for the Federal Reserve Bank. Remember, the Federal Reserve Bank is not a government agency. It is a privately owned bank. The Internal Revenue Service has to abide by the same collection laws and regulations imposed on any other collection agency.

So, once you received your assignment informing you of the IRS form 1065 you must file by April 15th, send to the same office who sent you your CP 575 B the following letter.

CERTIFIED MAIL REF# XXXX XXXX XXXX XXXX

DEPARTMENT OF THE TREASURY

INTERNAL REVENUE SERVICE

CINCINNATI OH 45999-0023RE: NOTICE DATED 04-21-2011

FORM: SS-4

EIN: 12-3456789

Notice to Agent is Notice to Principal

Notice to Principal is Notice Agent

Operations Manager:

This letter is written in response to Notice CP-575 B dated April 21, 2011 regarding “We assigned you an Employer Identification Number” containing a requirement that YOURCOMPANY, LTD., is required to file Form 1065.

This is to notify your agency that this New Mexico State formed Limited Liability Company does not come under the purview of 26CFR§1.6031(a)-1 as a domestic or foreign partnership with intended gross income effectively connected with the conduct of a trade or business within the United States or gross income derived from sources in the United States.

The partnership is not an eligible entity subject to “any” Federal tax classification because it is not a withholding foreign partnership as defined in Regulations section 1.1441-5(c) (2)(i) and has no U.S. partners.

The Employer Identification Number is needed “for banking purposes only.” Please take notice of this change of status. If your agency fails to respond to the contrary, please accept this NOTICE as a final change of status.

Yours truly,

Honcho of My Company

Encl. Employer Identification Notice from Agent

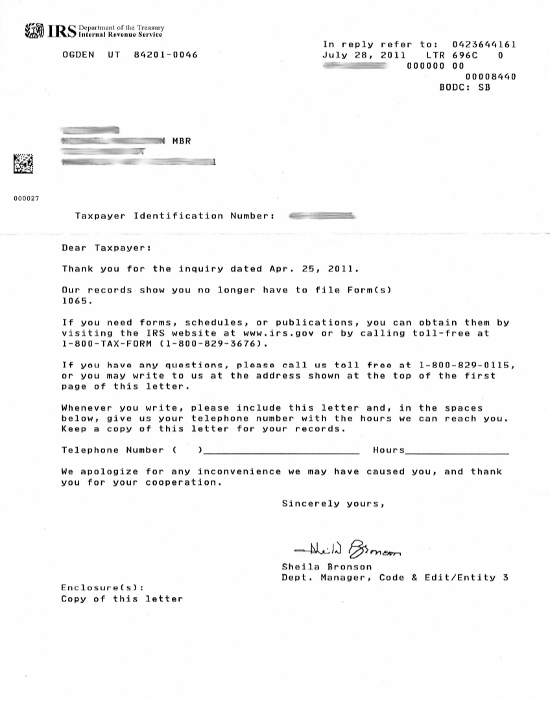

Yes, I was a little nervous the first time I used this letter. But when you are right, you have to stand your ground. The IRS gets all of its power from fear tactics and NONE of it from the law. You will be pleasantly surprised by the results of your letter. Some of these letters will come with a name and signature and some of them will not. I have received these responses in either way, but the result was the same both times. The following is the letter that I received from the IRS after I sent in my letter above.

The IRS always likes to give the appearance that it is the controling authority. Even though you did not ask any questions in your ltter, the respondent will still lay claim to having answered a question. Thanking you "for the inquiry".

The IRS always likes to give the appearance that it is the controling authority. Even though you did not ask any questions in your ltter, the respondent will still lay claim to having answered a question. Thanking you "for the inquiry".

However, the most important verbage in the letter are these words.

Our records show you no longer have to file a Form(s) 1065.

Now the IRS has agreed that you no longer are required to file a tax return for your company. If you have employees, you cannot be forced to serve as a withholding agent for the IRS. And you can tell all of your employees to refer to this site or take care of paying their "income" tax on their own. You can also help your employees by using the Certificate In Lieu of W-4, available in Open Document format and portable document format and give them the same opportunity you had. You might still want to refer them to this site, so that when they start getting those annoying letters from the IRS, they can learn how to challenge the authority of the IRS and join our forum for support on dealing with the IRS.

Defend Freedom™