Submitted by M. R. Hamilton on

Submitted by M. R. Hamilton on

The Federal Reserve - Why US Currency is Not Real Money

Gold and silver are considered real money in most parts of the world. Even in the united states of America, legal tender was backed by gold or silver until 1968 when the Federal Reserve Bank, finally convinced the congress to allow the FRB to remove any kind of real money backing whatsoever.

Before we get into how the Federal Reserve Bank operates, we should comprehend what money is. So let us take a look at the definition of "money" from before the Federal Reserve Bank "changed" it for most Americans. In Black's Law Dictionary, 4th edition, we find,

“MONEY. In usual and ordinary acceptation it means gold, silver, or paper money used as circulating medium of exchange, And does not embrace notes, bonds, evidences of debt, or other personal or real estate. Lane v. Railey, 280 Ky. 319, 133 S.W.2d 74, 79, 81.”

So now we are all clear that "money" means gold or silver or a paper representation of gold or silver. We will take a look at one of the "paper representations" below. We also know that it does not mean a promisory note or an I owe you.

An understanding of how the Federal Reserve Bank operates in conjunction with the federal government is important to understand why we would no longer have a gold standard for currency. The Federal Reserve Bank purchases, at cost, currency from the United States. The cost is about 2 ½ cents per bill. It matters not whether the bill is a 1 dollar bill or a 1,000 dollar bill. The cost is 2 ½ each. The federal reserve bank then loans the money back to the federal government at face value and is paid back with interest. The interest is in the form of funds collected through the voluntary "income tax" system.

If the FRB was required to back money with gold, then it could not have so much money at the stroke of a keyboard. All they have to do is tell the federal government when to print more money, the federal government then applies ink to paper, and presto, money magically appears.

One of the ways that the FRB has taken gold out of the standard is by, through the lending industry, not accepting gold or silver as a "liquid asset". What the lending industry is saying is "We don't accept money as a liquid asset." After wall, isn't that what gold and silver coins are? They are money. What some people do not realize, is the value of gold and silver has not risen in the last century. That is why the dollar amount imprinted on a one ounce gold coin is still $50. What has changed is the value of the currency that the federal government permits to be used. This currency is debt back by debt.

We used to back our money with gold or silver. US currency actually stated on the bill that it was redeemable for X amount of gold or silver or it was redeemable for X "Dollars". You won't find anything of the sort on a Federal Reserve Note.

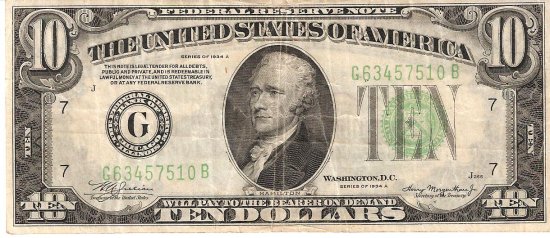

The following is a ten dollar bill printed in 1934. Note the large print along the center bottom states, "WILL PAY TO THE BEARER ON DEMAND TEN DOLLARS". Obviously, that indicates that the bill itself is not in fact money at all, but guaranteed that the bearer would be paid money when he turned in the bill to the US Treasury or "any Federal Reserve Bank".

The fine print in view of Hamilton's gaze (Click on image for larger view) states, "THIS NOTE IS LEGAL TENDER FOR ALL DEBTS, PUBLIC AND PRIVATE, AND IS REDEEMABLE IN LAWFUL MONEY AT THE UNITED STATES TREASURY OR ANY FEDERAL RESERVE BANK." (Empasis added) This serves as further evidence that this piece of paper is nothing more than a promissory note and is, in fact, not money. This piece of paper merely represent the guarantee of payment of money. So what has changed?

Now, we simply get the piece of paper. There is no money, just paper. It has no value other than what we give it. That is why the value of it continues to decline. There will come a day, as has happened in every country using a fiat money system, that the "money" will be worthless and those who thought enough in advanced to take it upon themselves to collect real money, ie: gold and silver, will be the only people who will survive the fiat currency collapse. It is estimated that an once of gold will cost $1,000 by the year 2010. (As we can see from when this article was orignally posted on our old site, we have far surpassed the amount predicted. As a matter of fact, gold has just recently dipped back to $1,300 per ounce.) Have you purchased any gold coins yet? You better start.

I recommend purchasing both gold and silver coins. When the FRN system finally collapses, you will need some smaller coins to use in trade. One of the best places to trade for gold or silver coins is through Bullion Direct® in their Nucleo™ Exchange. There you can buy and sell gold and silver with other individuals with Bullion Direct® serving as an intermediary. That way a 3rd party confirms what you are purchasing. You can then have them hold the gold in their safe or have them deliver it to you. Either way, you will own real money instead of fiat money.

You might find it hard to understand how the FRN system could collapse. For many decades the US dollar has been considered by the rest of the world as the most stable currency with which to trade. So even though a buyer and seller were neither located in the United States, they would still use the US dollar for the trade. For example, if Argentina sold oil to China, the US dollar is what China used to pay Argentina for the oil. When other countries stop using the US dollar for trading, the dollar will become more and more devalued making the cost of living soar. There are already numerous countries using other forms of curreny for trade due to the insecurity of the US dollar. The more others turn away from trading with the US dollar, the more likely this collapse. The day that no other country will take the US dollar in trade, will be the day that 49,000,000 (49 million) people on food stamps will be told by the US government, "Sorry, we have no food stamps for you this month. We will notify you when we do." What do you suppose will happen when 49,000,000 hungry people are told they will not receive their food benefit from the federal government?

How prepared are you?